Cost-of-living adjustment makes sure the backbone of our retirement system keeps pace with rising prices.

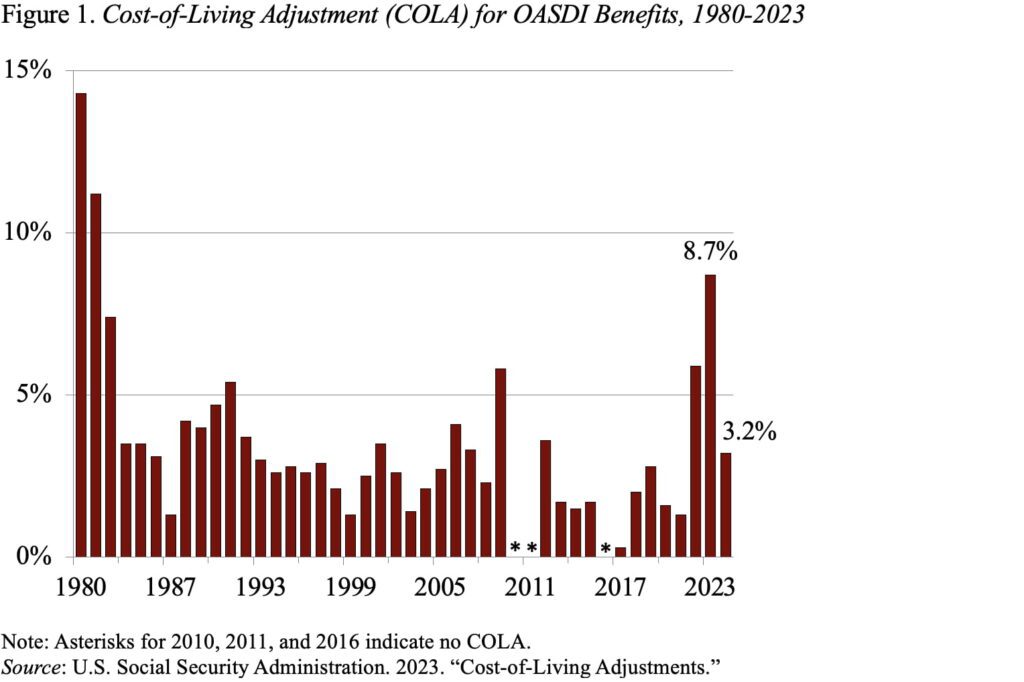

With the release of the September CPI-W inflation number, the Social Security Administration announced that the COLA for 2024 will be 3.2 percent (see Figure 1). The adjustment is based on the increase in the CPI-W for the third quarter of 2023 over the third quarter of 2022. Some bemoan that this year’s COLA is smaller than those in the past few years, but the adjustment is designed to compensate for rising prices, so as inflation drops, the magnitude of the required adjustment also falls.

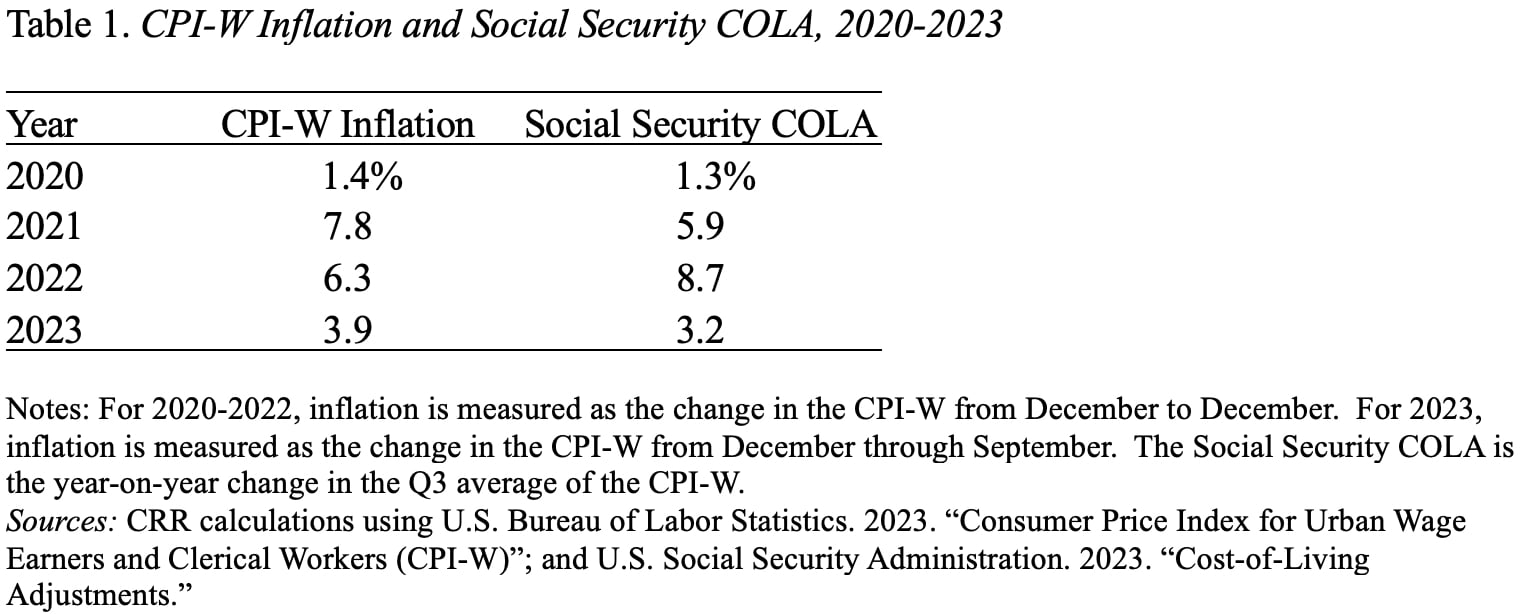

Social Security’s COLA does the job it’s meant to do. The last few years make that point in spades. The first column of Table 1 shows the December-to-December increase in the CPI-W each year from 2020 through 2022, with an estimate for 2023. The second column shows the COLAs announced in 2020 through 2023, which take effect in the following year. In essence, Social Security’s goal is to compensate for the increase in prices of 1.4 percent in 2020 by raising benefits by 1.3 percent in 2021. When inflation is fairly steady, inflation and the COLA are very close.

When inflation takes off, however, the backward-looking nature of the calculation means that – in the short term – the COLA provides less than a full adjustment. That is, in 2021 prices rose 7.8 percent from January to December, but the COLA announced for 2022 was only 5.9 percent (based on the third quarter of 2021 over the third quarter of 2020). This discrepancy caused great consternation at the time. But look what happened in 2022 – inflation slowed to 6.3 percent, but the COLA was much larger at 8.7 percent. So, COLAs tend to be too small when inflation begins and too large as inflation comes down. The important point is that, over the whole cycle, Social Security beneficiaries are fully compensated for inflation.

On a much smaller scale, this year’s COLA looks somewhat low compared to our estimate of the increase in prices for 2023. But my best guess is that inflation next year may dip below 3 percent and that the Social Security COLA announced next fall will be higher than actual inflation.

Social Security’s COLA is one of the most valuable aspects of the program’s design. It has always provided invaluable protection. Even an inflation rate as low as 2 percent cuts the purchasing power of a $1,000 benefit to $600 over a 25-year retirement. The COLA prevents that erosion. But the lack of drama means that the COLA goes unappreciated. The only good thing that may be said about the current inflation spike – which is harmful for all aspects of our lives – is that it has highlighted the value of having retirement benefits that keep up with prices.