A closer look at the Boeing negotiations only makes the question more puzzling.

Boeing workers recently accepted the company’s third offer. The agreement does not include reopening the Boeing defined benefit pension plan, which was cited as the major reason that the union rejected the second offer. Even though the strike is over, I find the fact that reopening the pension plan played such a prominent role in the negotiations really interesting.

After decades of thinking about retirement plans, my conclusion is that coverage is the major issue. A lifetime of participation in any type of employer-sponsored plan virtually ensures a secure retirement. In my view, the 401(k)/DB debate is a diversion.

Yet, the reopening of the pension plan was clearly important to Boeing workers. I can think of two reasons that might be the case: 1) the assumption that the employer pays for benefits under a defined benefit plan while the worker pays for 401(k) benefits; or 2) the benefits offered under the Boeing defined benefit plan were higher than those resulting from combined employee/employer 401(k) contributions.

No economist can accept the notion that the employer contribution to a defined benefit plan is an “add-on” that costs the employee nothing. Rather, the employer decides on a bucket of money that it can pay in total compensation – wages, health insurance, retirement etc. – and then allocates it among the various components to create the most desirable package. If employees make clear they want more employer contributions to a defined benefit plan, they will over time receive less in wages, health care, or other benefits. In other words, the employee pays regardless of whether retirement benefits are provided through 401(k)s or defined benefit plans.

The second issue requires comparing the benefits payable under Boeing’s defined benefit plan and its 401(k) arrangement. The agreed-upon contract included provisions for each:

- Defined benefit plan: In 2015, Boeing ended all benefit accruals for current and future hires, but some active workers still have credits in the plan. Boeing will increase the dollar per credited service (i.e., service earned before 2015) for all active workers from $95 to $105.

- 401(k) plan: Boeing will increase the employer matching contribution from 50% of the first 8% of an employee’s contributions to 100%. In addition, the company will make a supplementary 4-percent employer contribution program available to all employees (currently, it is only for those hired after 2015).

My colleagues JP Aubry and Yimeng Yin constructed a spreadsheet for workers at two salary levels based on the following assumptions:

- Salary: Growth 3% per year.

- Age: Starting at 35 and ending at 65.

- 401(k): Total contribution 20% (8% employee, 8% employer match, and 4% employer supplement).

- Defined benefit: Dollar per credited service $150 (reflecting a continuation of the growth in the credited amount between 2009 and the new contract).

- Rate of return: 6% and 4%.

- Annuitization of 401(k) balances (for comparability to defined benefit payment) based on immediateannuities.com.

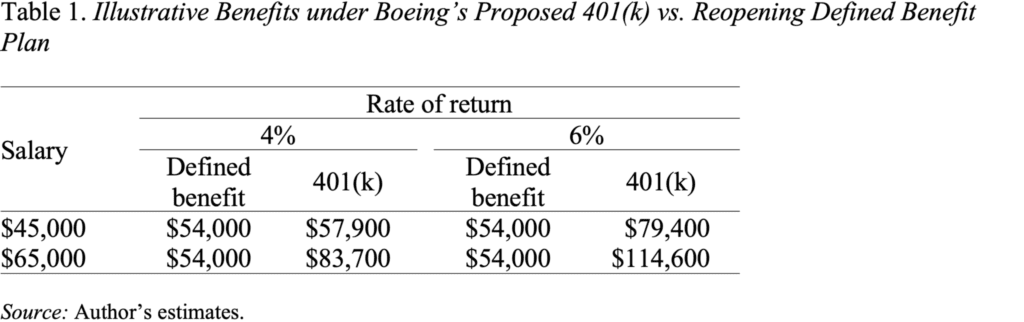

You can see the results of this exercise in Table 1. The benefit amounts look really high because all the calculations are in nominal, not inflation-adjusted, dollars. What we are interested in is the difference between the defined benefit and 401(k) amounts. The bottom line is that the 401(k) consistently outperforms the defined benefit plan. And the discrepancy is greater at higher salaries, which is not surprising given that the defined benefit is a flat amount per year of service (albeit with a floor related to a worker’s final wage) while the 401(k) contributions are based on earnings.

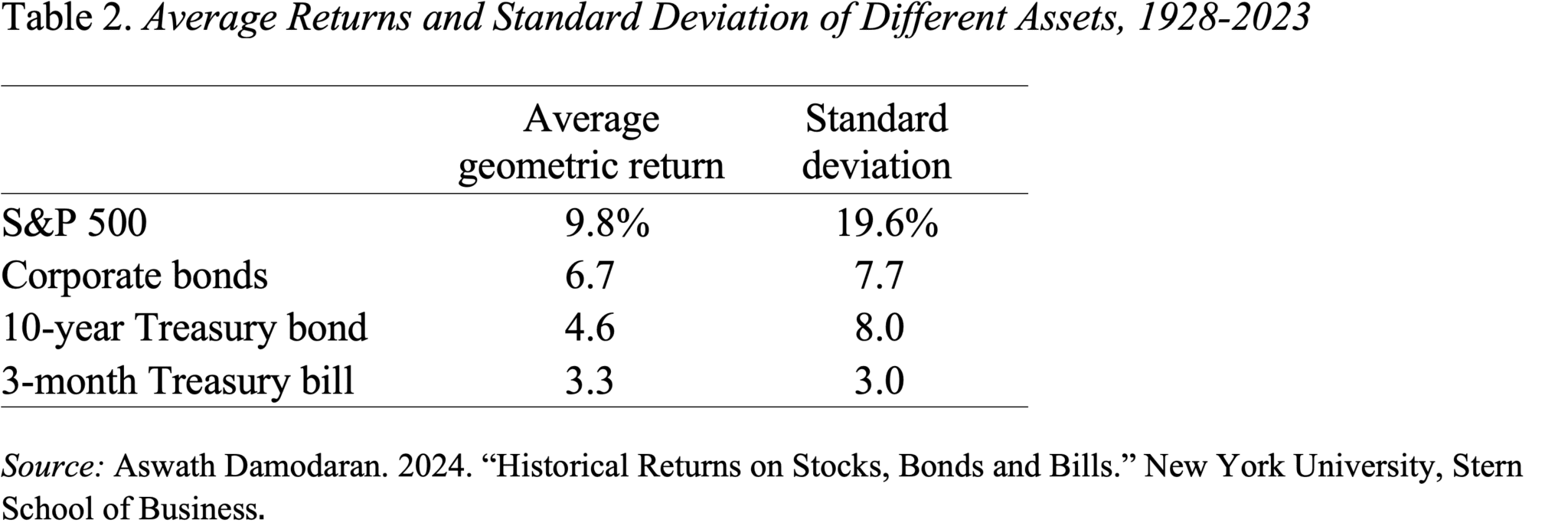

But what is more interesting to me is even at a 4-percent return – less than the historical average return on 10-year Treasuries (see Table 2) – the 401(k) plan does slightly better at the lower salary level. That means that a very risk-averse individual could invest their 401(k) assets only in Treasuries and come out ahead of the Boeing defined benefit plan.

Of course, this simple exercise involves a lot of caveats – employees may not choose to contribute the full 8% to the 401(k), salaries may grow more slowly, etc. But the results do make it hard to understand workers’ unwavering devotion to defined benefit plans.