This legislation would allow some workers to double-dip and speeds the exhaustion of the trust fund.

On November 12, the House passed the Social Security Fairness Act to repeal the Windfall Elimination Provision (WEP), which reduces Social Security benefits for workers receiving significant government pensions from jobs not covered by Social Security. A companion provision – the Government Pension Offset (GPO) – makes similar adjustments for their spouses and survivors.

Since their enactment in 1983, the WEP and GPO have infuriated state and local employees, who feel they are unfairly being denied benefits. In fact, these provisions are a legitimate – if imperfect – effort to solve an equity issue that arises because 25-30 percent of state and local workers are not covered by Social Security.

Clearly, we who support some form of adjustment have not done a very good job making the case. Let me try one more time. Essentially, state/local workers who spend their career not covered by the Social Security system but gain some minimum coverage either on side jobs or after retirement look like “low earners” to Social Security. As “low earners,” they profit from the progressive benefit structure, which was designed to help those with a lifetime of low pay – not those who earned a good living in jobs not covered by Social Security.

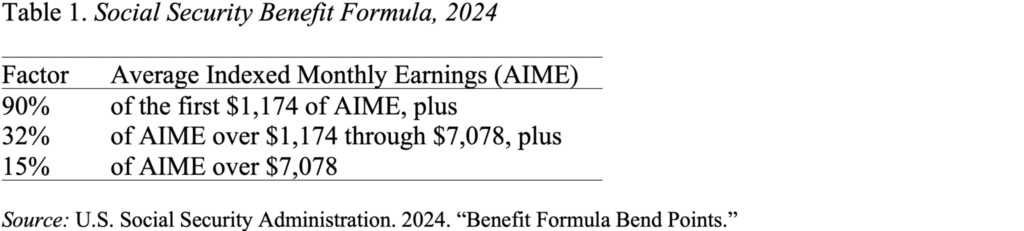

To see how that happens, look at the Social Security benefit formula. It applies three factors to the individual’s average indexed monthly earnings (AIME). Thus, in 2024, a person’s benefit would be the sum of 90 percent of the first $1,174 of AIME, 32 percent of AIME between $1,174 and $7,078, and 15 percent of AIME over $7,078 (see Table 1). Since a worker’s monthly earnings are averaged over a typical working lifetime (35 years), a high-wage earner with a short period of time in employment covered by Social Security looks exactly like a low-wage worker with lifetime coverage. If the AIME for each of these two workers is $1,174 or less, they both get a replacement rate of 90 percent.

Similarly, a spouse who had a full career in uncovered employment – and worked in covered employment for only a short time or not at all – would be eligible for the spouse’s and survivor’s benefits.

The WEP is designed to eliminate these inequities for workers by reducing the first factor in the benefit formula from 90 percent to 40 percent; the other two factors remain unchanged. It is not a perfect solution – the benefit cut is proportionately larger for workers with low AIMEs, regardless of whether they were a high- or low-earner in their uncovered employment.

Most observers agree that the WEP could be better designed. Kevin Brady (R-TX) has repeatedly introduced legislation with a new formula. First, the regular Social Security factors would be applied to all earnings – both covered and uncovered – to calculate a benefit. The resulting benefit then would be multiplied by the share of the AIME that came from covered earnings. Such a change would produce smaller reductions for the lower paid and larger reductions for the higher paid.

Improving the design would be a welcome change. But it makes no sense to allow state and local workers who gain minimum coverage under Social Security to profit from the program’s progressive benefit formula. The offsets are fair. Moreover, eliminating the offsets would also accelerate the exhaustion of the trust funds by six months and require larger across-the-board cuts once the assets are depleted. Hence reform, not repeal, is the answer.

In the end, of course, the long-run fix is to extend Social Security coverage to all state and local workers, which would both offer better protection for workers and eliminate the equity problem.